Expert California Real Estate & Mortgage Solutions Team

Proven Results in Buying, Selling & Financing Homes

Complete Real Estate & Lending Support in One Place

Buy a Home – Fast pre-approvals & winning offers

Sell Your Home – Maximize value with strategic pricing

Mortgage & Refinance – From full-doc to Hard Money & Second Mortgages

Reverse Mortgage – FHA & proprietary options made simple

Home Valuation – Instant, accurate home value snapshot

Find Your Next Home - Live Listings, Trusted Agents & Local Market Insights

🔒 We Keep It Real (and Personal)

Kiyoshi Inui, President

"Solve was built to fix what big banks broke; trust, clarity, and real results. We treat every deal like it’s our own, because our name’s on it.”

Buy, sell, or refinance your home — all with trusted local experts, fast approvals & zero call center scripts. FHA, VA, jumbo, reverse, non-QM & more.

Family-Run & Veteran-Owned: grounded in values, not volume

40+ Years of Combined Experience: in lending, real estate & equity strategies

One Team for Everything: buy, sell, finance & invest with one consolidated team

5-Star Rated on Google, Yelp, Facebook: with hundreds of California homeowners served

🛡️ Fully Licensed & Transparent: no BS, just clear guidance and real results you can count on

✅ Real Solutions. Real Results.

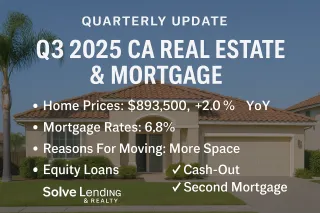

Q3 2025 SoCal Housing & Mortgage Market Update

See how SoCal home prices, rates, and equity loans shifted in Q3 2025. Solve Lending & Realty explains buying, selling, and financing trends now. ...more

Real Estate ,Buyers Sellers &Mortgages

October 01, 2025•0 min read

Fed Rate Cut: What It Means for Mortgages & HELOCs

The Fed just cut rates. Discover how it affects mortgage rates, HELOCs, and second mortgages — and what buyers, sellers, and homeowners should do now. ...more

Buyers ,Sellers &Mortgages

September 18, 2025•0 min read

Q2 2025 California Real Estate Market Update:

California Real Estate Market Update for Q2 2025. Explore current mortgage rates, housing inventory, economic shifts, and what buyers, sellers, and borrowers should know to make the most of the curren... ...more

Real Estate ,Buyers Sellers &Mortgages

July 10, 2025•5 min read

Family Roots

Locally owned, family trusted.

True Partnership

We’re by your side, start to finish.

Smart Solutions

Creative loans & real estate answers.

Equal Housing Opportunity

Company DRE ID: 02123993

For information purposes only. This is not a commitment to lend or extend credit. Information and/or dates are subject to change without notice. All loans are subject to credit approval.

By submitting above, I authorize an affiliated Solve Lending & Realty representative to call me, send text messages and emails to me about property valuations and financing options at the number entered above even if I'm on a National or State "Do Not Call" list. You can opt-out anytime, data and message rates may apply.

©2026 Solve Lending & Realty. All Rights Reserved.